Why AXIS

We are primary casualty specialists

If an organization could potentially be held legally liable for an accident that results in bodily injury, personal injury or property damage, it needs the financial protection that primary casualty insurance provides. Our primary casualty specialists have in-depth experience understanding the unique challenges companies' today face.

We provide tailored coverage for premium accounts ranging from $25K to $2.5M+. Count on us as your dedicated wholesale-only, first stop for primary casualty risks.

100% dedicated to the wholesale distribution network

Broad risk appetite including general and product liability insurance

Highly specialized underwriting and claims teams

Solutions

Tailored coverage for a variety of risk exposures

AXIS General Liability Insurance coverage helps protect organizations from accidents that happen as a result of normal business operations. These might include bodily injury, personal injury, and property damage claims.

Companies that produce, distribute or sell products need protection from the fallout that occurs in the event that their products cause bodily injury, personal injury or property damage. Consumers can be harmed in many different ways depending on how a product is designed, manufactured, marketed or used. Product liability lawsuits can be expensive to defend. AXIS Product Liability Insurance helps cover legal expenses associated with those types of claims.

AXIS General Liability Insurance coverage helps protect organizations from accidents that happen as a result of normal business operations. These might include bodily injury, personal injury, and property damage claims.

Companies that produce, distribute or sell products need protection from the fallout that occurs in the event that their products cause bodily injury, personal injury or property damage. Consumers can be harmed in many different ways depending on how a product is designed, manufactured, marketed or used. Product liability lawsuits can be expensive to defend. AXIS Product Liability Insurance helps cover legal expenses associated with those types of claims.

Capabilities

- Capacity: Up to $2,000,000 limits of liability

- Minimum Premium: $100,000 for most classes

- Minimum Deductible: $5,000

- Minimum Self-Insured Retention: $25,000

Target classes

Construction, including:

- General contractors and developers

- Artisan and trade contractors

- Commercial, industrial, and selective residential

- Crane and rigging

- Practice and Project Specific placements

For more information, access our Primary Casualty Construction market fact sheet here.

Hospitality (Accommodation and Food Services)

- Bars, lounges, and night clubs

- Hotels and motels

- Restaurants and taverns

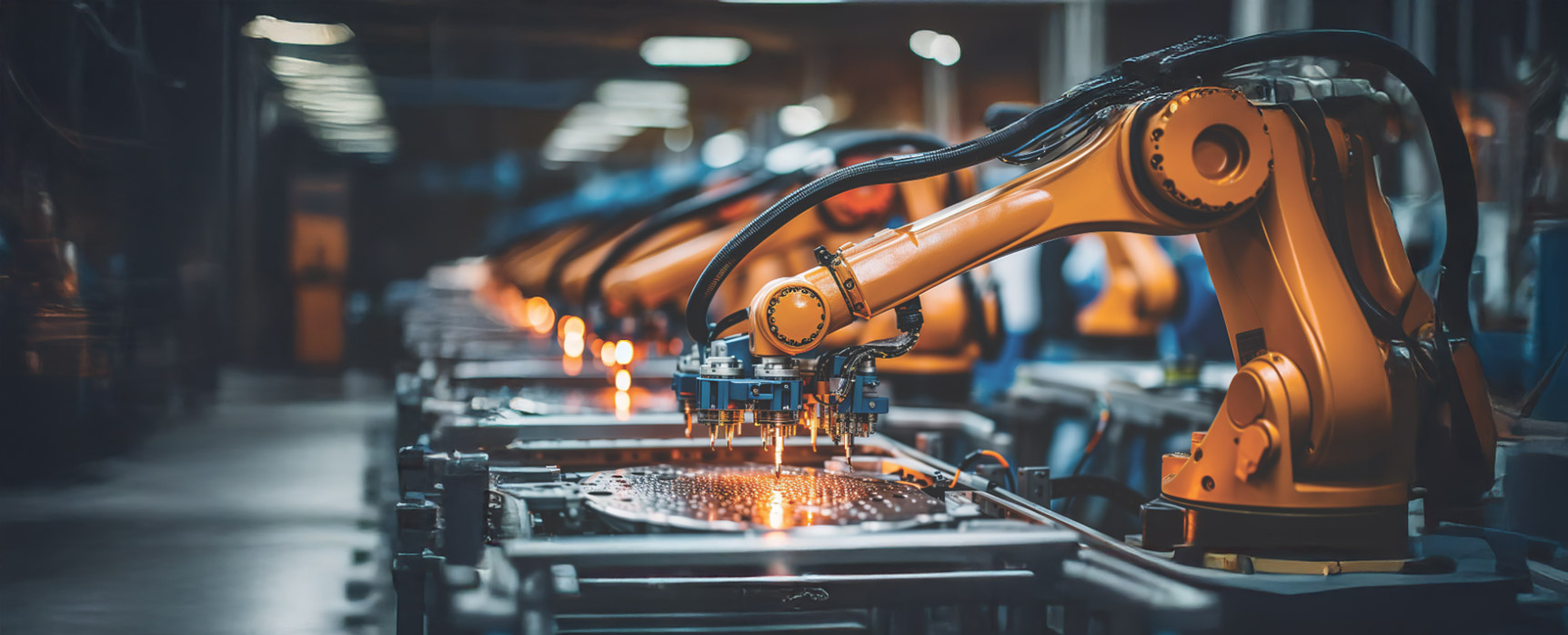

Manufacturers and Distributors — Commercial

- Boiler and machinery equipment

- Construction equipment

- Farm equipment

- Industrial machinery

- Lift and elevator equipment

- Truck and motorcycle component parts

Manufacturers and Distributors — Consumer

- Appliance manufacturers

- Exercise equipment

- Food and beverage

- Furniture

- Playground equipment

- Sporting goods

- Toys

Building and Premises

- Banks and financial institutions

- Commercial real estate

- Habitational real estate

- Shopping centers

- Strip malls

Retail

- Convenience stores

- Retail stores

- Supermarkets

Miscellaneous Classes

- Amusement parks and devices

- Arcade centers

- Bowling alleys

- Car washes

- Family fun centers

- Janitorial services and supplies

- Security guards

- Warehouses

Claims

We deliver on our promises

Effective resolution for customers is achieved with our highly skilled claims specialists focusing on:

- Quick decision making

- Championing your needs

- An honest approach

∗Claims examples may be based on actual cases, composites of actual cases or hypothetical claim scenarios and are provided for illustrative purposes only. Facts have been changed to protect the confidentiality of the parties. Whether or to what extent a particular loss is covered depends on the facts and circumstances of the loss, the terms and conditions of the policy as issued and applicable law.

Related

What’s happening at AXIS

Related news and updates across the organization

Find your future at AXIS

We are a global insurer and reinsurer tackling unique challenges. At the heart of it all? Our people. As unique as the risks we face.