An Underwriter's Lens

By Helen Steadman, Head of Marine Cargo, AXIS Global Markets

This article was first published in The Marine Insurer, April 2025 edition, which can be found here can be found this article.

In a dynamic risk environment in which many newsworthy events have a marine cargo ‘angle’—whether it is a warehouse engulfed in wildfire, Middle East conflict, a terror attack, or a sinking ship—our instinct as underwriters when a new headline appears is to reach for our laptops and hammer the details into our systems. Through information garnered from our data, or a switched-on claims colleague or broker partner, within minutes, we start the complex process of identifying affected parties and overlaying this with our own portfolio, to determine whether we are on risk or to what extent. Summarising this vital information in a single sentence, ready to relay almost instantaneously, is par for the course for the marine underwriter who needs to act with speed, ready address enquiries and to pre-empt the call from above and that inevitable question: is it one of ours?

The thick of it

Sitting at your box at Lloyd’s or, more often the familiar surroundings of the open-plan office or desk at home, it is possible to appear insulated from the world’s crises even as they lap shores increasingly close to home.

However, for London cargo underwriters, me included, mapping the effects of turbulent geopolitics and disruptions to global trade, and working with market peers to create responsive, flexible solutions, is built into our working lives. We read and absorb risk reports and work closely with our claims specialists who, through their daily conversations, are closely tuned into the realities outside. As underwriters, our discussions with brokers and insureds on the fresh challenges they are navigating every day help us to hone our appetites, pricing, and terms & conditions to meet increasing or decreasing level of risk as we see it and elevate the solutions we deliver.

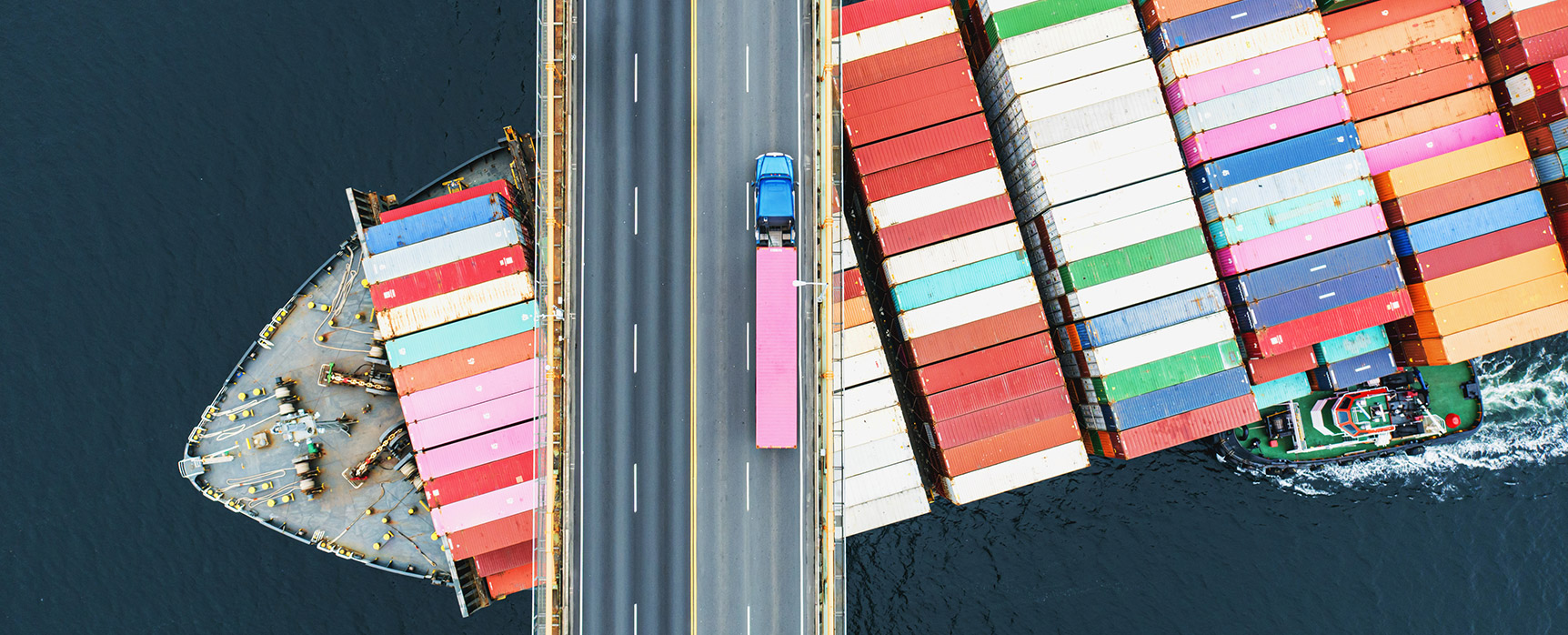

Site visits in our line of work are as valuable in building a picture of the evolving risk landscape as the data at our fingertips. Access to useful data is improving all the time—helping to monitor accumulation risk, while recognising the complexities involved with tracking goods in transit. As we remind colleagues in adjacent lines of insurance business, storage units, also covered by cargo, are inherently easier to trace than their contents, which, as soon as it is on the move, may encounter myriad risks along their trade routes, from war and terror acts to new tariffs or sanctions, to weather-related diversions.

For the seasoned cargo underwriter, today’s disruptions are truly unprecedented— even five years on from a pandemic that triggered a near total shutdown in global trade. How else do you describe the current unpredictable world defined by economic instability, climate change, and the erosion of decades of geopolitical norms? We are all operating under the assumption that normality may not resume any time soon—we know this, and our underwriting ought to reflect this.

Finding solutions in volatile times

The challenges in the market are coming in thick and fast and it remains as important as ever that as a market we continue pricing in the unpredictability of the geopolitical and economic climate to our underwriting decisions. As a specialty market, we excel in providing solutions in volatile times and this responsiveness is key to our success.

Because the cargo market has been relatively cushioned from the impacts of the volatile environment is no cause to relax on rate or terms & conditions. Unlike when the giant curveball of Covid-19 changed our market, there is no let-up in activity and therefore claims amid today’s uncertainty. Nor is it long ago that the London market experienced the Decile-10 years, and it is questionable why any underwriter would risk stepping back to those ill-disciplined times and undoing the gains that pain ultimately did for the marine market in particular.

Following a sustained period of rate resiliency post-Decile 10, we are seeing single-digit rate deterioration in 2025. As new capacity continues to flow in and the market’s bifurcation into lead versus follow continues, market incumbents need to lead by example in showing discipline and foresight to ensure these signs of softening do not lead us into escalating unprofitability and weakening T&Cs.

At AXIS, we believe there is a fine line that we ourselves are treading between necessary market modernisation through increased portfolio underwriting and facilitisation that add value and efficiency for all and investing in maintaining strong and differentiated leaders in the open market.

We cannot stop the major losses—fires, trade wars, terror attacks—that we are here to respond to. But we are capable through discipline and foresight of minimising the self-inflicted wounds caused by a race to the bottom on rate and terms. And if a stick were needed, Lloyd’s has made it clear in recent statements that it will not tolerate a slide backwards in underwriting standards that would risk dragging a market segment back into unprofitability.

Building bench strength

Another piece of the puzzle in building a sustainable cargo market that is future proofed against the next twists and turns of global trade and geopolitics is investing in our people. With 25-plus years’ experience, I have worked through previous market cycles and developed a long-term view of how the cargo market responds to and withstands world events. It is incumbent on experienced underwriters to take the training and development of newer underwriters seriously. We are cognisant of the deep competition for talent in the London market and, as line sizes increase, cargo teams need to attract and retain engaged, up-and-coming underwriters who can ensure the market retains its edge as a home for challenging, complex, and specialty risks. Curiosity and passion cannot be taught but a disciplined, flexible, informed approach to specialty underwriting can be modelled and learned.

Our purpose in developing elevated, specialty solutions to meet the evolving needs of customers is best fulfilled when we work together in our common interest. This must be founded on price adequacy, fairness and service for customers, and informed underwriting to build a strong, sustainable market where we learn from the past and prepare for a turbulent future.

Please try another search term our browse our insurance and reinsurance solutions.